rsu tax rate california

Carol Nachbaur April 29 2022. If you also paid tax to Massachusetts California may allow a.

Equity Compensation 101 Rsus Restricted Stock Units

You are granted 10000 rsus shares of company stock that vest at a rate of 25 a year.

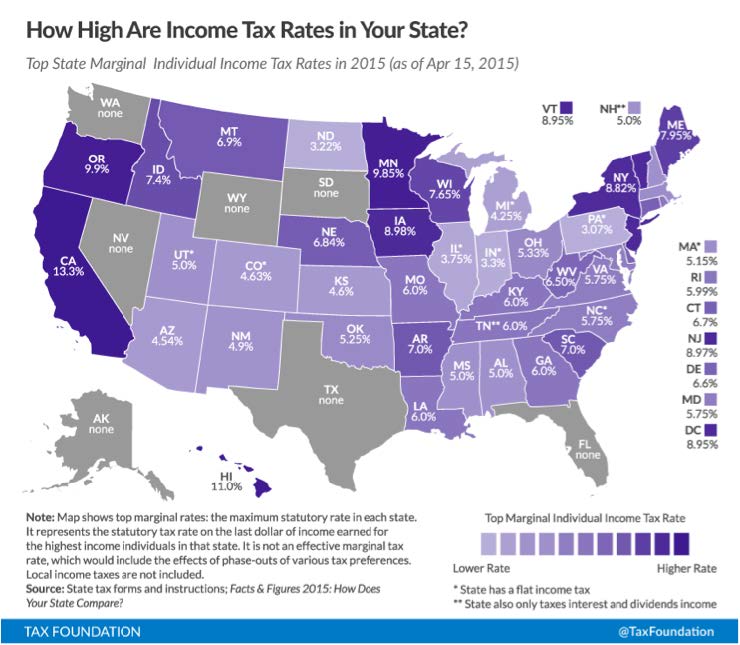

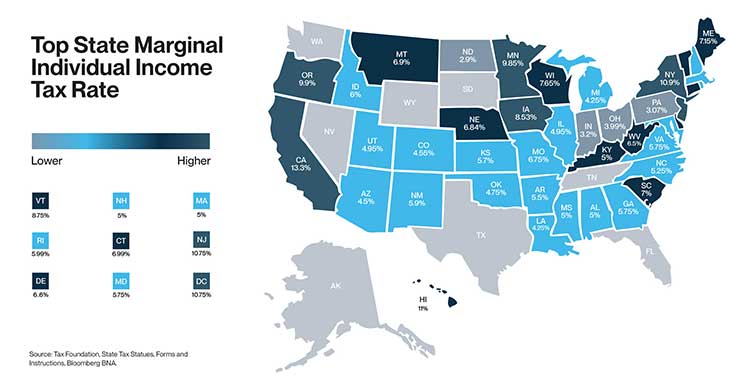

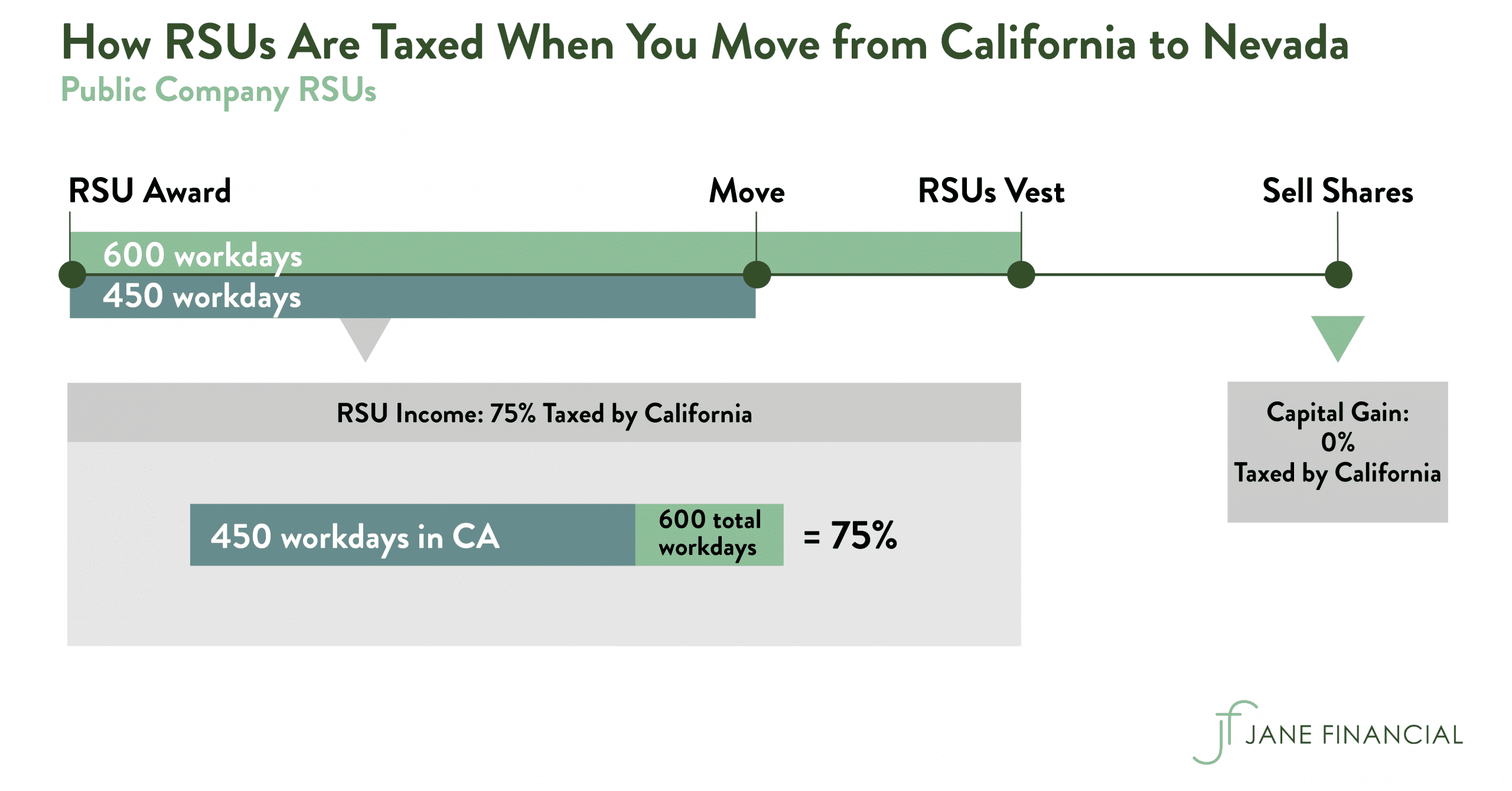

. California taxes the resulting ordinary income and capital gain because you are a California resident when the stock is sold. Federal Income Tax - Varies based on income. For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income.

Rsu tax in california after vest. California taxation of RSU income happens in two steps. This is different from incentive stock.

RSUs are supplemental income - theyre withheld at a 25 federal rate and a 102 rate in CA. RSUs including so-called double. As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs.

Vesting after making over 137700. Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. RSUs represent an unsecured promise by the.

RSUs resemble restricted stock options conceptually but differ in some key respects. Vesting after Social Security max. Since your regular paychecks.

The capital gains tax rate when you sell the shares you own. In this article Im sharing everything you need to know about how Restricted Stock Units RSUs are taxed. California taxes vested RSUs as income.

Sidelight May 1 2018 16 Comments Bookmark. Step 5 - Review Outputs of RSU Tax Calculator. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

The four taxes youll owe when you receive a paycheck or when an RSU vests include. How is RSU state tax calculated. 2510276 43 withholding that you saw.

Your RSU is for a specific number of stock units. In order to make. With an all-in tax rate of 15 you only need to pay.

Im getting 30k in rsu each year and was wondering how much. How Are Restricted Stock Units RSUs Taxed. On the day that they vest that number of stock units is multiplied by the value of the stock on that day and that number is considered taxable.

Your company is required to withhold a fixed. Once all the assumptions have been entered the RSU tax calculator will provide three outputs and they are all pretty self. C2reason 8 yr.

What Are Restricted Stock Units. Spouse with a california agi of 90896 or less 120 credit individual tax rates the maximum rate for individuals is 12 3. The capital gains tax rate when you sell the shares you own.

Social Security Tax - 62 up to. A app to help calculate how much tax you pay on RSUs.

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Are You Thinking Of Moving Your Primary Residence To A Tax Advantaged State Silicon Valley Bank

How To Handle State Taxation Of Stock Options After You Move

Sunpower Spin Out 3 The Rsu Tender Offer Presentation

How Do I Diversify My Rsus Executive Benefit Solutions

When Do I Owe Taxes On Rsus Equity Ftw

Should My W2 Include Income From An 83 B Election

Leaving California With Equity The Tax Implications Modern Financial Planning

Should I Hold Or Sell My Rsus Sofi

Rsu And Taxes Restricted Stock Tax Implications

Restricted Stock Units Jane Financial

Changes To Accounting For Employee Share Based Payment The Cpa Journal

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

Rsus And The Expatriation Tax Sf Tax Counsel

Restricted Stock Units Jane Financial

California Income Tax And Residency Part 2 Equity Compensation And Remote Work Parkworth Wealth Management

How To Manage Us Rsus And Stock Options Awards When Living Overseas Money Matters For Globetrotters